If you’re living the digital nomad dream—working from Bali one month and Lisbon the next—tax season probably isn’t your favorite time of year. But if you’re a U.S. citizen or green card holder, your global lifestyle doesn’t exempt you from Uncle Sam’s reach, which makes managing your taxes as a digital nomad an essential part of staying compliant.

That’s right—even if you earn your income in euros, pesos, or baht, you still need to file U.S. taxes. But don’t worry. This guide makes managing your taxes as a digital nomad simple, legal, and a whole lot less stressful.

We’ll break down how to stay compliant, avoid double taxation, and even uncover deductions and exclusions that could save you serious money.

👉 Related: Digital Nomad Tips: Simplify Life on the Road Today

🌍 Managing Your Taxes as a Digital Nomad: Understanding Global Tax Obligations

Who Needs to File Taxes While Abroad?

Here’s the deal: If you’re a U.S. citizen or green card holder, you must report your worldwide income—no matter where you live or earn it.

That includes:

- Freelance gigs (yes, even the ones paid in crypto or via PayPal)

- Remote employee salaries

- Income from your own business

- Rental or investment income

- Side hustles and digital product sales

Even if you’re not living in the U.S., the IRS still wants to know what you’re earning. Skipping a tax return could lead to penalties—so it’s worth getting it right.

How Tax Residency Impacts Managing Your Taxes as a Digital Nomad

Here’s something that often confuses nomads: Your tax residency in other countries doesn’t cancel out your U.S. tax obligations.

Most countries use a residency-based taxation system—meaning if you stay there more than a certain number of days (often 183 days), you may be taxed like a local.

The U.S., however, follows citizenship-based taxation, which means you’re taxed on your income no matter where you live. (Yes, even if you haven’t stepped foot in the States all year.)

The good news? You can often avoid being taxed twice thanks to tax treaties and credits—more on that soon.

Foreign vs. Domestic Employment

Where your employer is based can also affect your tax situation.

- Working for a U.S. company? You’ll likely have to pay self-employment tax (Social Security and Medicare) if you’re a freelancer, or check if your employer is handling withholding properly.

- Working for a foreign company or client? You may need to register as self-employed in that country or deal with local taxes. But don’t panic—this can often work in your favor if the local tax rate is lower.

Quick Tip: Keep detailed records of where you work from, who pays you, and how much you earn. You’ll thank yourself at tax time.

💸 Strategies to Reduce Tax Liability

When you’re managing your taxes as a digital nomad, the good news is: you don’t have to pay more than your fair share. There are smart, legal ways to lower what you owe, even while working abroad.

Here are three powerful tools that can help you reduce your U.S. tax bill:

Foreign Earned Income Exclusion (FEIE)

The FEIE lets you exclude up to $130,000 (for 2025) of foreign-earned income from your U.S. taxable income. That’s a huge break—if you qualify.

To use the FEIE, you need to pass one of these tests:

- Physical Presence Test – You must be physically outside the U.S. for 330 full days in a 12-month period.

- Bona Fide Residence Test – You must have a tax home in a foreign country and live there as a bona fide resident for at least one full tax year.

⚠️ Common mistake: Trying to qualify for the FEIE when you haven’t actually met the physical or residency requirements. The IRS doesn’t play around—keep detailed travel records!

Foreign Tax Credit (FTC): A Smart Tool for Managing Your Taxes as a Digital Nomad

If you pay taxes to a foreign government, the Foreign Tax Credit lets you offset your U.S. tax liability by the amount you’ve already paid abroad. It’s ideal when:

- You can’t use the FEIE because you don’t meet the qualifications, or

- Your foreign tax rate is higher than the U.S. rate.

FEIE vs. FTC:

- FEIE lowers your taxable income.

- FTC lowers your actual tax bill.

You can sometimes use both, but not on the same income. A tax pro can help you decide what mix makes the most sense.

Tax Treaties & Double Taxation Agreements

The U.S. has tax treaties with dozens of countries that can help you avoid being taxed twice.

Benefits may include:

- Lower rates on certain income (like dividends or royalties)

- Clarified rules for residency

- Relief from double taxation on income types not covered by FEIE or FTC

🔎 Pro tip: Check the IRS website or your host country’s tax authority for treaty details. Treaties vary by country and income type—so don’t assume you’re covered without confirming.

🧾 State Taxes and Tax Residency Planning

Cutting Ties with U.S. States

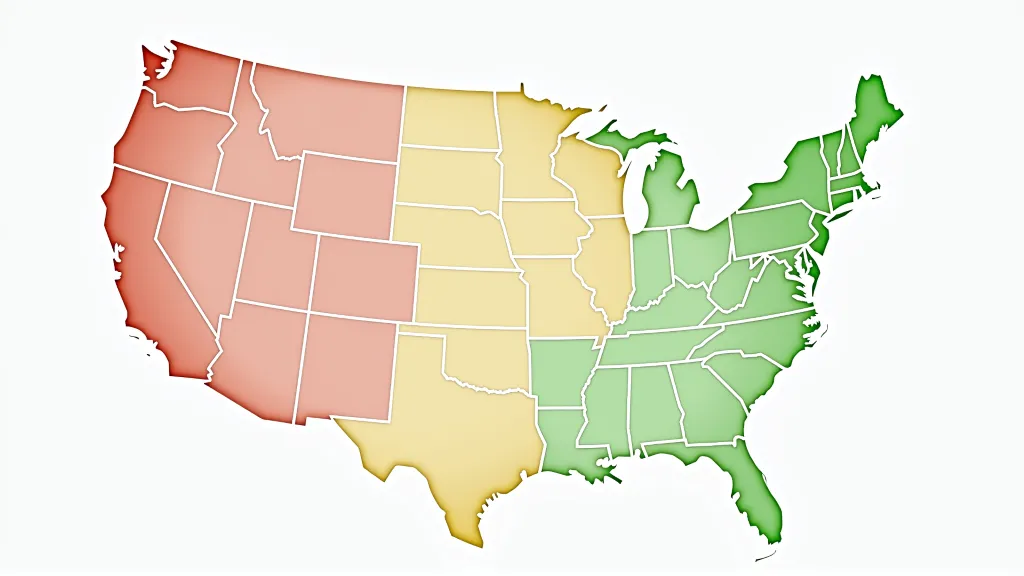

Even if you’re sipping coconut water in Thailand, your home state might still want a piece of your income. Some states, like California and New York, are known for clinging on to taxpayers long after they’ve gone abroad.

Here’s the issue: If a state considers you a resident, you might still owe state taxes—even if you haven’t lived there all year.

To break up with your state tax obligations, you’ll need to show proof of a clean break:

- Change your driver’s license and voter registration to a no-income-tax state (like Texas or Florida).

- Close your old lease or sell your property.

- Establish a permanent address elsewhere—consider a trusted mail-forwarding service that provides a real U.S. street address.

It’s all about showing that your intent and actions match up.

“Convenience of Employer” Rule Explained

Here’s a tricky one: Some states (like New York) use the “convenience of employer” rule, which can require you to pay state taxes even if you work remotely from another country.

If your employer is based in one of these states, they might still consider your income taxable there—unless your remote work is for business necessity, not just convenience.

📚 Deductions, Write-Offs, and Compliance Tips

Self-Employment Tax Considerations

If you’re freelancing or running your own business abroad, you still owe self-employment tax to the U.S. That’s 15.3% for Social Security and Medicare—and it adds up quickly.

But here’s the good news: You might be able to reduce or avoid it if your host country has a Totalization Agreement with the U.S. This prevents double contributions to social security systems.

💡 Example: If you’re working in Germany and paying into their system, you may not have to pay SE tax to the U.S.—but you need to file Form 8833 and show proof.

Legitimate Deductions for Nomadic Work

Working from a hammock still counts—as long as it’s business-related, it may be deductible. Here are some common write-offs digital nomads use:

- Coworking spaces

- Wi-Fi and software subscriptions

- Tech gear (laptop, headset, external drive)

- Home office setup (even if temporary)

- Travel expenses for client meetings or business events (keep receipts!)

🧠 Tip: Make sure the expenses are ordinary and necessary for your work. Personal travel and leisure costs? Not deductible.

Tools for Record-Keeping & Filing

Digital nomads love automation—and your taxes should be no different.

Use tools like:

- QuickBooks Self-Employed, FreshBooks, or Expensify to track your income and deductions.

- Notion, Google Drive, or Dropbox to store receipts, invoices, and mileage logs.

And yes, back it all up. If the IRS ever comes knocking, having an organized digital paper trail can save you big headaches.

🌐 Special Tax Considerations for Managing Your Taxes as a Digital Nomad

Sojourning Rule & Foreign Residency

You might love the idea of hopping from one country to the next, but stay too long, and you could accidentally become a tax resident.

Here’s the deal: Many countries apply a 183-day rule—if you spend more than half the year there, they may consider you a tax resident, even if you don’t have a visa or long-term lease.

That means:

- You could owe local taxes on your income.

- You may need to file tax returns in multiple countries.

- You’ll want to watch your travel calendar closely.

✈️ Pro tip: Use apps like Nomad List or Taxee.io to track your days in each country.

Business Entity Structure for Digital Nomads

If you’re freelancing or running a remote business, choosing the right structure matters—especially when crossing borders.

- Sole Proprietor: Simple to set up, but may limit legal protection.

- LLC: Offers liability protection and potential U.S. tax benefits. Can still work well even while abroad.

- Foreign Corporation: Useful if you’re based outside the U.S. long-term, but it adds complexity and more reporting (hello, Form 5471!).

🌍 Where should you register? Many nomads use their last U.S. state of residence or a state with favorable tax laws (like Wyoming). Just make sure your entity setup aligns with where you actually operate.

📌 Action Steps for Managing Your Taxes as a Digital Nomad

Consult with an Expat Tax Professional

Sure, DIY is tempting—but international taxes are a whole different game. A tax advisor who understands expat and nomad-specific rules can help you:

- Avoid costly mistakes or double taxation

- Leverage tax treaties, credits, and exclusions

- Customize your plan based on where you work and live

👥 Think of them as your financial travel buddy—keeping you legal and saving you money.

Annual Tax Checklist for Managing Your Taxes as a Digital Nomad

Stay on top of your taxes with this quick checklist:

- 📊 Track all income (freelance, remote work, passive)

- 📅 Know your deadlines (U.S. expats usually get an automatic 2-month extension)

- 📄 File the right forms:

- Form 1040 – your standard return

- Form 2555 – Foreign Earned Income Exclusion

- Form 1116 – Foreign Tax Credit

- FBAR – Report foreign bank accounts (if combined value exceeds $10,000)

🗂️ Keep everything organized and cloud-backed—your future self will thank you.

🧭 Conclusion: Final Thoughts on Managing Your Taxes as a Digital Nomad

Managing your taxes as a digital nomad doesn’t have to be a nightmare. By understanding your obligations, choosing the right strategies like the FEIE or FTC, and planning ahead, you can stay compliant and keep more of what you earn.

🎯 Remember: A qualified expat tax professional can make your life way easier—and reduce your risk of surprises from the IRS or foreign governments.

✨ Ready to thrive on the road?

👉 Check out our guide for even more lifestyle tips:

Digital Nomad Tips: Simplify Life on the Road Today